In a notable departure from the growth-centric, expansionary approach of recent years, the interim government of Bangladesh has proposed a conservative national budget of Tk 7.9 trillion (Tk7.90 lakh crore) for the fiscal year 2025–26.

The budget aims to rein in inflation, tackle economic challenges, and lay the foundation for sustainable growth in the near future.

Finance Adviser Dr Salehuddin Ahmed, unveiling the maiden budget of the Yunus-led interim government on Monday, said the focus had shifted from infrastructure-led development to a more people-centric, holistic model.

“This time, our core objective is to ensure an improved quality of life for all and build a future Bangladesh grounded in equality and non-discrimination,” Dr Ahmed said. He emphasised strengthening the economy’s foundation over merely accelerating GDP growth.

Conservative Approach Amid Economic Pressures

The proposed budget marks a 0.9% cut from the current fiscal year’s original outlay of Tk 7.97 trillion (Tk7.97 lakh crore).

Key goals include reducing the budget deficit, containing interest and loan repayment burdens, and stabilising the taka-dollar exchange rate to provide relief from inflationary pressures.

Despite this conservative approach, the government has set an ambitious GDP growth target of 5.5% for FY2026, slightly above the revised 5.25% projection for the current fiscal year.

However, international financial institutions such as the World Bank, IMF, and ADB anticipate Bangladesh’s growth to remain below 5%.

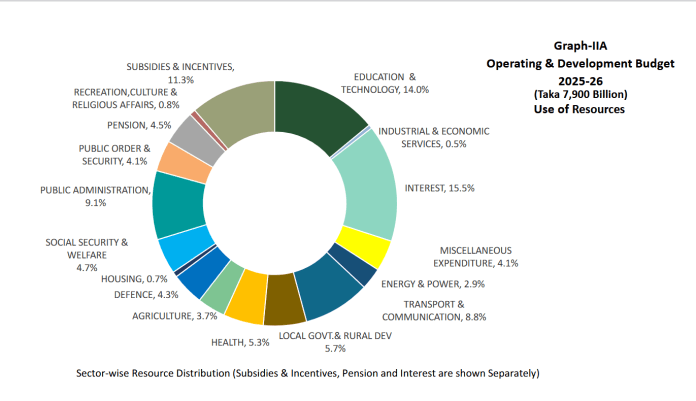

Development Priorities and Sectoral Focus

The budget gives special emphasis to education, healthcare, skills development, employment, entrepreneurship, good governance, and civic amenities.

It also highlights the importance of climate resilience, sustainable development, LDC graduation, and harnessing opportunities from the Fourth Industrial Revolution.

Trade, investment, and social safety nets are prioritised. The development budget has been trimmed by Tk350 billion to Tk2.3 trillion, while operating expenditures have risen by Tk280 billion to Tk5.6 trillion. Fiscal and monetary policy coordination will be strengthened.

Budget Deficit and Revenue Targets

The FY2026 budget projects a deficit of Tk2.26 trillion—3.6% of GDP—down from Tk2.56 trillion in FY2025.

Of this, Tk1.25 trillion will be financed from domestic sources, primarily bank borrowing, while Tk1.01 trillion will come from foreign sources.

Total revenue collection is targeted at Tk5.64 trillion (9% of GDP), with Tk4.99 trillion expected from the National Board of Revenue (NBR) and Tk650 billion from other sources.

Interest payment obligations are projected at Tk1.22 trillion, including Tk1 trillion for domestic and Tk220 billion for foreign debt servicing.

To ease the fiscal burden, Bangladesh anticipates additional budget support of $3.6 billion from development partners by June.

Reform Measures and Public Sector Adjustments

Efforts to boost domestic revenue include modernising the tax system, expanding the tax net, rationalising exemptions, implementing a uniform VAT rate, and updating various fees to increase non-tax revenue.

The Annual Development Programme (ADP) has been scaled back to Tk2.3 trillion from Tk2.65 trillion.

Priority is given to the transport sector, while long-term and mega projects have been excluded, except for the ongoing Matarbari development project.

A sum of Tk50.40 billion is allocated for public-private partnership (PPP) initiatives.

Non-development expenditures will rise, with substantial allocations for debt servicing, food subsidies, banking sector reforms, and continued support for agriculture, fertilisers, and electricity.

Energy and Power Sector Reforms

To ease inflationary pressure, the government will not raise electricity tariffs. Instead, it plans to cut production costs by 10% to reduce subsidy requirements.

VAT on imported LNG has been withdrawn to lower energy costs for both gas companies and consumers.

The government plans to supply 648 million cubic feet of gas from domestic sources this year and extract an additional 1,500 million cubic feet by 2028.

Agriculture and Social Safety Nets

A total of Tk170 billion is allocated for agricultural subsidies, including fertiliser support and incentives under ongoing rehabilitation programmes.

In social welfare, key allowances will be raised from July: old-age allowance from Tk600 to Tk650, widow and destitute women from Tk550 to Tk650, disability benefits from Tk850 to Tk900, mother and child benefit from Tk800 to Tk850, and new Tk650 monthly stipend for marginalised communities.

Relief for Savers, Startups and Digital Connectivity

To benefit small savers, the excise duty threshold on bank deposits will rise from Tk100,000 (Tk1 lakh) to Tk300,000 (Tk3 lakh).

The current Tk150 duty will now apply only to balances exceeding Tk300,000.

A Tk1 billion fund is proposed for ICT startups, along with the establishment of 491 Upazila-level ICT training centres to boost digital skills and entrepreneurship.

To enhance digital affordability, the source tax on internet services will be reduced from 10% to 5%, and the turnover tax on mobile operators will be lowered from 2% to 1.5%.

LDC Graduation and Trade Strategy

As Bangladesh prepares to graduate from the Least Developed Country (LDC) category in November 2026, a Smooth Transition Strategy (STS) has been unveiled to address challenges and leverage new opportunities.

To enhance competitiveness, short- and long-term plans have been outlined for logistics development and trade agreements with countries including China, Japan, Sri Lanka, Singapore, Malaysia, and Korea.

Additional measures include: establishing a solid waste treatment plant at Savar tannery, operationalising the Active Pharmaceutical Ingredient (API) park in Gazaria, Munshiganj, and strengthening potential sectors like leather and pharmaceuticals,

The pharmaceutical industry has already achieved self-sufficiency and is exporting to over 150 countries, aided by consistent policy support.