Bangladesh will require between US$933 million and US$980 million annually until 2030 to achieve its 20 percent renewable energy target set under the Renewable Energy Policy 2025, according to a new report by the Institute for Energy Economics and Financial Analysis (IEEFA).

Beyond 2030, the annual investment requirement will rise to US$1.46 billion to meet the next target of generating 30 percent of electricity from renewables by 2040, the report titled “Catalysing Renewable Energy Finance in Bangladesh” says.

“Public finance alone is unlikely to meet these funding needs, making large-scale private investment crucial,” said Shafiqul Alam, lead energy analyst for Bangladesh at IEEFA and co-author of the report.

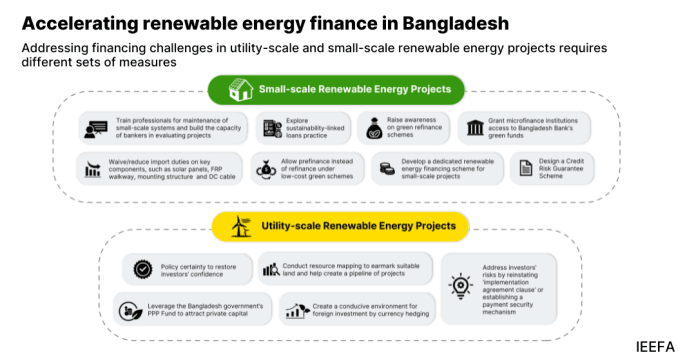

However, the report identifies several barriers to private investment, including abrupt policy shifts, off-taker and technology risks, weak project pipelines, land acquisition hurdles, foreign exchange volatility, and low sovereign credit ratings.

The government recently suspended 31 utility-scale renewable projects awarded under non-competitive bidding, transitioning to a competitive bidding model. The move, while intended to ensure transparency, has introduced contractual uncertainty and shaken investor confidence.

The report highlights that Bangladesh should ensure regulatory stability, restore investor guarantees, map and allocate land for projects, and build capacity in both the banking and service provider ecosystems to attract investment.

The report underscores the importance of reinstating the “project implementation clause” to dispel uncertainties over payment or establish a funding mechanism to provide revenue assurance to renewable energy producers, mitigating counterparty risks.

“Land acquisition challenges can be mitigated through the Public-Private Partnership model, which can help mobilise investment in renewable energy projects through special economic zones,” Alam suggests.

“In the case of small-scale renewable energy projects, their accelerated deployment will depend on addressing the high import duty on critical components, performance issues and perceived risks. Easing lending norms for green funds can also help scale up such projects,” says Labanya Prakash Jena, Sustainable Finance Consultant, IEEFA.

The report acknowledges the government’s positive move in reducing the customs duty on imported solar inverters and calls on the government to reduce the import duty on components of small-scale solar projects, such as solar panels, FRP walkway, mounting structure and DC cable.

The report emphasises the importance of adopting a pre-finance modality of the Central Bank’s green funds to minimise delays and simplify disbursement.

Bangladesh’s low sovereign credit ratings also deter foreign investors. “Moody’s downgraded Bangladesh’s credit rating to B2 in November 2024 from B1 earlier, based on the country’s lower-than-expected economic growth in the near term, political challenges and banking sector risks.

This has further deteriorated the country’s credit profile in the international financial market, making borrowing expensive,” notes Jena.

“The government, international organisations, financial institutions, private investors, and renewable energy companies should collaborate to create a conducive environment that fosters innovation, investment, and sustainable growth,” Alam emphasises.