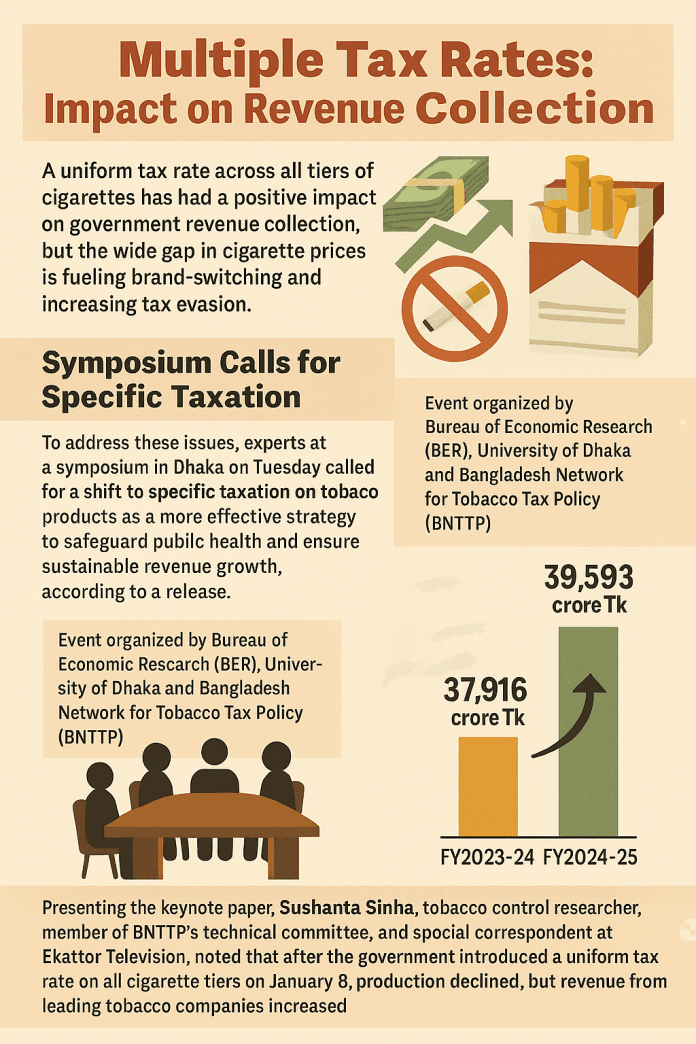

A uniform tax rate across all tiers of cigarettes has had a positive impact on government revenue collection, but the wide gap in cigarette prices is fueling brand-switching and increasing tax evasion.

To address these issues, experts at a symposium in Dhaka on Tuesday called for a shift to specific taxation on tobacco products as a more effective strategy to safeguard public health and ensure sustainable revenue growth, according to a release.

The event, titled “Multiple Tax Rates: Impact on Revenue Collection,” was jointly organized by the Bureau of Economic Research (BER) at the University of Dhaka and the Bangladesh Network for Tobacco Tax Policy (BNTTP).

The symposium took place at the BER conference room and was attended by public health experts, economists, policymakers, academics, and anti-tobacco advocates.

Presenting the keynote paper, Sushanta Sinha, tobacco control researcher, member of BNTTP’s technical committee, and special correspondent at Ekattor Television, noted that after the government introduced a uniform tax rate on all cigarette tiers on January 9, production declined, but revenue from leading tobacco companies increased.

According to his data, revenue from British American Tobacco Bangladesh, Japan Tobacco International, and Abul Khair Group totaled Tk 37,916 crore in FY2023–24, rising to Tk 39,593 crore in FY2024–25.

“This proves wrong the tobacco companies’ narrative that increasing taxes would lower government revenue,” Sinha said. He further alleged that at least one multinational tobacco company is artificially inflating its operational expenses to evade taxes.

Additionally, he said cigarette companies are selling products above the maximum retail price (MRP), costing the government an estimated Tk 5,000 crore in lost revenue annually.

Sinha recommended introducing a specific tax of Tk 1 per cigarette stick as a starting point. “Even under a mixed tax structure, this could raise government revenue by Tk 20 crore daily and significantly improve public health outcomes,” he added.

Speaking as a panelist, policy analyst and legal expert Advocate Syed Mahbubul Alam Tahin emphasized the need to reintroduce the 25% export duty on raw tobacco, which was withdrawn earlier.

He warned that the exemption has triggered a surge in tobacco cultivation in Bangladesh, making local tobacco leaves the cheapest in the region. “The environmental, health, and economic costs demand urgent policy reversal,” he said.

Professor Dr. Rumana Haque, economist at Dhaka University and convener of the BNTTP technical committee, argued that merely increasing the price of tobacco products is not enough. “Tax rates must be raised in tandem with prices.

Without this coordination, neither revenue nor public health will benefit,” she said. Haque also criticized the use of ambiguous terms like “or higher” in tax policy, which allow companies to exploit loopholes and facilitate brand-switching and tax evasion.

She strongly advocated for the adoption of a comprehensive national tobacco tax policy, alongside the move to specific taxation.

Hamidul Islam Hillol, project director of BER, delivered the welcome remarks, and Ibrahim Khalil, senior project and communication Officer at BER, moderated the session.

The symposium was attended by representatives from tobacco control organizations, researchers, students, journalists, and public health professionals.