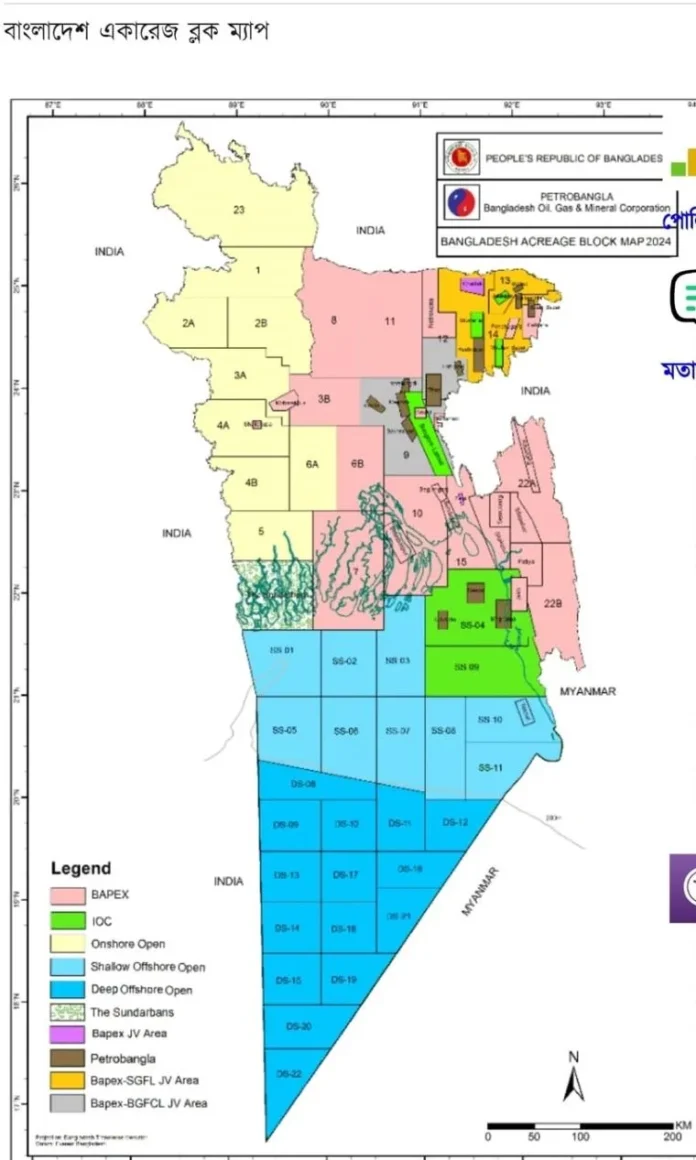

US energy major Chevron Bangladesh has sought exclusive rights over 6,226 square kilometres across Onshore Blocks 11 and 12, a request that would bypass the government’s Model Production Sharing Contract (PSC) framework.

Block 11 is operated solely by state-owned Bapex, while Block 12, home to the country’s largest gas field Bibiyana, is operated by Chevron.

Chevron’s proposal

On 4 December 2024, Chevron formally expressed interest in securing exclusive exploration rights over the two blocks.

The Energy and Mineral Resources Division (EMRD) acknowledged the proposal on 15 January 2025, but noted that the government plans to launch a competitive bidding round for new onshore exploration later this year.

While EMRD said it “highly appreciates” Chevron’s interest, it made clear that exclusive acreage cannot be granted outside the bidding process. Chevron also proposed an Investment Support Agreement, which EMRD said requires further clarification.

Key financial disputes also remain unresolved

A cost recovery dispute is under arbitration at the International Centre for Settlement of Investment Disputes (ICSID).

Issues regarding Workers’ Profit Participation Fund (WPPF) obligations are pending with the Ministry of Labour and Employment.

EMRD added that the government values Chevron’s cooperation and remains open to dialogue.

The government has formed a new committee last month led by a former EMRD secretary Mohammad Mohsin to examine Chevron’s latest request.

A committee member on the condition of anonymity noted that under the Model PSC, the government has no legal authority to grant Chevron additional onshore acreage without competitive bidding.

He also pointed out that the previous government extended Chevron’s tenure under the Special Powers Act, a provision no longer available.

Bibiyana contract already extended

EMRD clarified that the production period for Bibiyana (Block 12) has already been extended to 2034, with an additional five-year extension approved. Further extensions may be discussed later, but must strictly follow existing PSC terms.

Chevron again sought exclusive rights over Blocks 11 and 12, but EMRD reiterated that the government will proceed with competitive bidding, not direct negotiation.

A powerful group has revived efforts to hand over several proven onshore fields to Chevron, reviving a year-old proposal, EMRD sources said.

Chevron, already the largest gas producer in Bangladesh, operates in about 400 sq km under its Bibiyana block. The company is lobbying to secure an additional 6,226 sq km, covering proven fields such as Rashidpur, Chatak and Sunetra.

Rashidpur is operated by Sylhet Gas Fields Ltd while Chatak remains suspended due to an international arbitration dispute.

Officials say Chevron has pushed since the previous administration to acquire these blocks at “offshore-style pricing”, despite the areas being low-risk onshore fields.

In December 2024, Chevron sought rights in Rashidpur across Blocks 8, 11 and 12. The former government rejected the Rashidpur request but conditionally approved Blocks 8 and 11 under the Special Act.

Petrobangla rejected the proposal in January 2025, saying the Special Act had been repealed and no block can be awarded without bidding.

The review committee added that offshore price formulas cannot be applied to onshore fields, which are significantly cheaper and less risky to operate.

Although Chevron’s earlier proposal was rejected in early 2024, officials say lobbying has intensified in recent months.

Energy expert and CAB Adviser Dr Shamsul Alam warned that granting acreage without bidding would violate national interests.

“It would be a violation of national sovereignty if the government grants additional areas without bidding,” he said, calling the move “treason” and those supporting it “national traitors.”

He said offering proven onshore fields at offshore-style pricing would sharply raise costs for Bangladesh.

Chevron’s proposal is based on the 2023 Offshore Model PSC, where gas prices equal 10% of Brent crude.

At Brent $100, the gas price would be $10 per MCF, far higher than earlier PSC rates ($5.6 in shallow offshore and $7.25 in deep offshore).

Chevron currently sells Bibiyana gas at $2.76 per MCF.

At Rashidpur, SGFL supplies gas at roughly Tk1 per cubic metre; under Chevron’s proposed rate (e.g., $8 per MCF), the price would jump to about Tk34 per cubic metre.

Chevron responds

Asked for comment, Media and Communications Manager at Chevron Bangladesh Sheikh Zahidur Rahman said the company respects government and Petrobangla processes.

“As a matter of long-standing policy, we do not comment in detail on commercial matters,” he said.

“Our focus remains on working in partnership with Petrobangla and the Government under our PSCs to continue safely, reliably and affordably supplying natural gas to Bangladesh.”

Chevron currently produces 1,017 MMcf/d, more than half of Bangladesh’s total domestic output of 1,736 MMcfd.