Bangladesh’s Power Division has urged the Energy and Mineral Resources Division (EMRD) to adjust the tariff of heavy fuel oil (HFO) towards market-based pricing, warning that inflated fuel costs are driving up electricity generation expenses and widening the government’s subsidy burden.

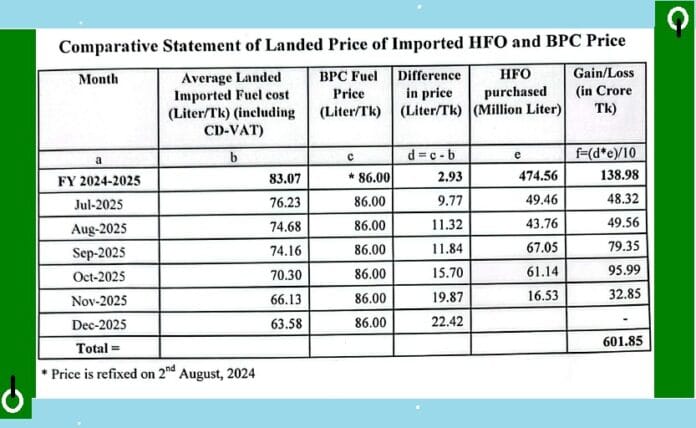

In an official demi-official (DO) letter sent on 4 January 2026, the Power Division said the Bangladesh Power Development Board (BPDB) incurred losses of Tk 602 crore in the first six months of the current fiscal year due to the higher price of HFO supplied by the state-owned Bangladesh Petroleum Corporation (BPC).

Official data from October 2025 show that HFO supplied by BPC cost power producers about Tk 86 per litre, compared with Tk 66 per litre for fuel imported privately.

The impact becomes sharper when translated into generation costs. Privately imported HFO resulted in a fuel cost of around Tk 13.92 per kilowatt-hour, while BPC-supplied fuel raised the cost to Tk 19.10 per kilowatt-hour — a difference of Tk 5.18 per unit.

Power Division officials said the higher price of BPC fuel significantly inflates electricity generation costs at HFO-based plants, particularly those operating under power purchase agreements that allow full pass-through of fuel costs to BPDB. BPC last revised the HFO tariff on 2 August 2024.

According to BPDB officials, the tariff differential alone caused losses of Tk 602 crore in the first half of the current fiscal year, following losses of Tk 139 crore in the previous fiscal year.

The Ministry of Finance has already approved Tk 37,000 crore in electricity subsidies for the current fiscal year. The Power Division warned that the subsidy requirement could rise further if EMRD does not act on the proposal.

BPDB has planned to generate at least 3,213 megawatts of electricity using HFO during the peak Boro irrigation season between April and May 2026, citing shortages of lower-cost natural gas and delays in coal procurement.

Meeting sources said BPDB has instructed 38 oil-fired power plants—both state-owned facilities and private independent power producers—to remain ready for the irrigation period. The directive was issued at a meeting held on 4 January 2026.

“HFO-based plants are already high-cost facilities,” said a senior official familiar with the discussions. “When fuel is priced above market levels, it directly raises the bulk supply cost of power and increases the subsidy burden.”

BPDB has repeatedly required budgetary support to bridge the gap between generation costs and regulated consumer tariffs, with HFO-based plants among the largest contributors to losses, officials said.

The issue was formally reviewed at a high-level meeting on 14 December 2025, chaired by Power and Energy Adviser Muhammad Fouzul Kabir Khan and attended by senior officials from both the Power Division and the Energy and Mineral Resources Division. The meeting concluded that BPC’s HFO pricing should be revised urgently to reflect prevailing market rates.

In its letter, the Power Division argued that a shift to market-based HFO pricing would ease pressure on public finances by lowering fuel costs for both state-owned and private power plants, reducing BPDB’s losses and helping to stabilise electricity tariffs over time.

BPDB chairman Engr Rezaul Karim just said the utility could face growing challenges in securing primary fuels in the coming months.

BERC Moves to Set Furnace Oil Prices After 15-Month Delay

Fifteen months after the interim government took office, the Bangladesh Energy Regulatory Commission (BERC) has begun the process of determining furnace oil prices. As part of the statutory procedure, a public hearing has been scheduled for 29 January.

BERC has invited stakeholders wishing to participate in the hearing, to be held at its hearing chamber, to submit written applications by 22 January.

Furnace oil is the second most widely used fuel in Bangladesh after diesel, with power plants accounting for the bulk of demand. During the 2023–24 financial year, sales totalled 955,912 metric tonnes. Of this, 34.87 per cent was refined domestically at Eastern Refinery Limited, while the remaining 65.14 per cent was imported.