Bangladesh’s independent power producers have warned that it will be “extremely difficult” to maintain electricity supplies unless long-overdue payments are settled, despite pledging full co-operation with the country’s new government.

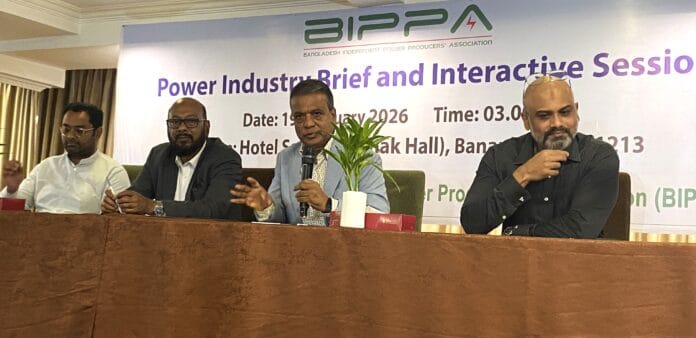

Speaking at a briefing in the capital on Thursday, David Hasnat, president of the Bangladesh Independent Power Producers Association (BIPPA), said producers were striving to keep power flowing but could not do so indefinitely without receiving arrears.

BIPPA has repeatedly cautioned that continued non-payment would jeopardise supply. Responding to questions, the association’s former president Imran Karim said that when the interim administration took office in June 2024, outstanding dues to private power plants were equivalent to four months’ billing. That figure has since risen to between eight and ten months.

He claimed that although the interim government reduced arrears to three months in 2025, payments subsequently stalled, with only sporadic settlements covering 10 to 15 days at a time. Overdue bills to furnace oil-based power plants have now exceeded Tk140 billion.

Karim said the mounting arrears were hampering imports of furnace oil, while several companies were struggling to service bank loans. “If we cannot import fuel, how can electricity be generated?” he asked, alleging that foreign companies had been paid on time while local entrepreneurs in power sector remained unpaid — a situation he described as “extreme discrimination” with impose of LD only for local power suppliers.

Hasnat added that from July onwards bill payments were scaled back and, instead of settling dues, authorities decided to impose Liquidate Damage (LD).

He alleged that the move was deliberate, aimed at creating load-shedding problems for the incoming administration. He also accused the previous government, led by the Awami League, of pressuring plant operators to remain online despite arrears, including through phone calls from the Directorate General of Forces Intelligence (DGFI).

BIPPA representatives said they had written repeatedly to seek payment but were threatened when attempting to suspend operations. They further alleged unequal treatment between local and foreign power producers, citing the example of the Chinese-owned Barishal Power Company, which they said was initially fined Tk 2.7 billion in similar circumstances but later had the penalty refunded.

Under the terms of their contracts, Karim argued, the Bangladesh Power Development Board (BPDB) forfeits the right to demand electricity if it fails to pay bills on time. He claimed that penalties were imposed even during periods when generation had been curtailed at the authorities’ request.

Private producers, who account for more than half of Bangladesh’s electricity output, also expressed frustration at not being consulted on new policy measures affecting the sector. “We generate over 50 per cent of the country’s power, yet a policy was formulated without even calling us,” Hasnat said.

Legal action is being pursued to challenge the penalties, with BIPPA saying it hoped the courts and the Bangladesh Energy Regulatory Commission would deliver a fair judgment.

Faisal Chowdhury, chairman of Baraka Group, said investors had channelled hard-earned overseas funds into Bangladesh’s power sector but had been unable to distribute dividends for two years because of the arrears. He accused the interim administration of adopting a hostile stance towards local producers.

Earlier this month, ahead of the election, BIPPA warned that continued generation would be difficult without payment of outstanding bills. In response, the newly appointed power, energy and mineral resources minister, Iqbal Hasan Mahmud Tuku, said such remarks amounted to “blackmail”.

Hasnat rejected that characterisation, saying it was understandable that the new government might perceive the warning as pressure but insisted producers were merely outlining operational realities. “We are trying in every way to maintain production,” he said. “But if banks refuse to open letters of credit, we cannot purchase fuel. We are simply informing the government of the situation.”