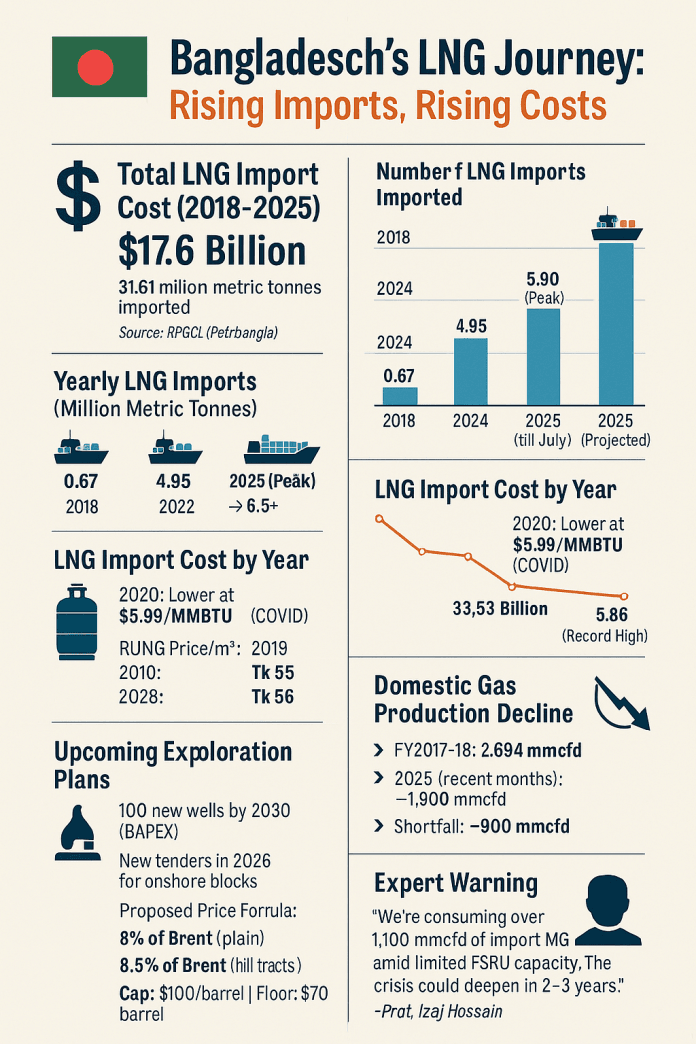

Since entering the global liquefied natural gas (LNG) market in 2018, Bangladesh has spent over $17.6 billion to import 31.61 million metric tonnes of LNG, amid declining domestic gas production and rising demand across industries, households, and the power sector, according to data from Rupantarita Prakritik Gas Company Ltd (RPGCL), a subsidiary of state-owned Petrobangla.

LNG imports have become a cornerstone of Bangladesh’s energy mix, though the reliance has come at a mounting fiscal cost due to global price volatility and surging demand.

Import volumes have increased sharply – from 11 cargoes in 2018 to 86 in 2024. In just the first six and a half months of 2025 (up to July 15), Bangladesh has already imported 56 cargoes, with the total projected to reach at least 108 by year-end. In 2026, imports are expected to rise further to between 124 and 126 cargoes, reflecting growing dependence on imported LNG as local production continues to fall.

LNG imports rose from 0.67 million metric tonnes in 2018 to a record 5.80 million tonnes in 2024. The corresponding cost also soared, with $3.53 billion spent in 2022 and $3.54 billion in 2024. The fiscal pressure stems from a significant drop in domestic production – from 2,694 mmcfd in FY2017-18 to around 1,800 mmcfd in recent months.

Price swings add to fiscal burden

LNG prices have been highly volatile. The average price fell to $5.99 per MMBTU in 2020 during the COVID-19 pandemic but surged to $16.22 in 2022 following the Russia-Ukraine war. As of mid-July 2025, the average price has eased to $11.86 per MMBTU.

Prices in the spot market were even more erratic, peaking at $28.47/MMBTU in FY2021-22 before falling to $12.17 in FY2025 (through July). A senior Petrobangla official told Just Energy News that recent payments of past dues helped reduce spot LNG costs by $1-$1.5/MMBTU, now averaging $12.22.

In a recent move, the government approved the purchase of one LNG cargo from Gunvor Singapore for Tk 513.45 crore.

RLNG consumption reaches record levels

Re-gasified LNG (RLNG) supply reached 8,361 MMCF in FY2024-25 (up to mid-July), averaging 1,016 MMSCFD – an all-time high. This growth reflects deepening reliance on RLNG to meet rising demand across the power, industrial, and residential sectors.

However, the expansion comes with higher consumer costs. The price of RLNG per cubic meter has increased from Tk 38 in 2018 to Tk 56 in 2025, adding pressure on both consumers and the government’s subsidy obligations.

Amid growing demand, Chief Adviser Professor Muhammad Yunus on Sunday urged Saudi Arabia to invest in a land-based LNG terminal at Matarbari. Energy Adviser Dr. Fouzul Kabir also held a high-level meeting to accelerate LNG infrastructure development.

Subsidies and exploration plans

To bridge the gap between import and retail prices, the government has earmarked Tk 6000 crore in the FY2025-26 budget for LNG subsidies.

Yet, energy officials stress that increasing domestic gas production remains essential. Petrobangla GM Md. Imam Uddin Sheikh cited a daily shortfall of around 900 mmcfd and urged industries to relocate to economic zones for better gas distribution.

BAPEX GM Engr. Mohammad Ahsanul Amin said the company plans to drill 100 new wells by 2030 to boost output. Meanwhile, Energy Secretary Mohammed Saiful Islam told Just Energy News that tenders for new onshore oil and gas blocks will likely be invited early next year.

Petrobangla has proposed a pricing formula pegged at 8% of Brent crude for onshore plain lands and 8.5% for hill tracts, with a price ceiling of $100 per barrel and a floor of $70. “We may even fast-track the bidding process pending ministry approval,” said a Petrobangla official requesting anonymity.

Experts urge policy shift

The latest data underscores Bangladesh’s growing exposure to international energy markets. Experts advocate a dual-track strategy: accelerating domestic exploration and investing in renewables to reduce external vulnerability, while also rationalizing subsidies to strengthen fiscal resilience.

Energy expert Professor Izaj Hossain warned of an approaching crisis. “We are already consuming over 1,100 mmcfd of imported LNG despite limited FSRU capacity and funding constraints. With low drilling success and delays in local output, the energy crisis may worsen over the next two to three years,” he said.