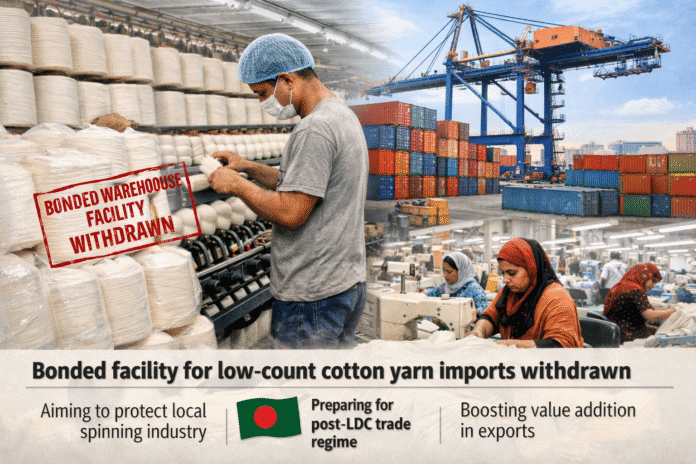

The government has withdrawn the bonded warehouse facility for the import of 10 to 30 count cotton yarn used in export-oriented readymade garment factories, aiming to protect the domestic spinning industry and increase value addition in exports ahead of Bangladesh’s graduation from least developed country (LDC) status.

The decision is also intended to strengthen the country’s preparedness for the post-LDC global trade regime, where higher local value addition and stricter rules of origin will become mandatory.

The Ministry of Commerce has instructed customs authorities to ensure that the yarn count is clearly mentioned in the bill of entry and to intensify monitoring to prevent misuse of HS codes. Officials said stricter enforcement would be key to ensuring the effectiveness of the decision.

In a letter signed on January 12 by the ministry’s WTO Cell-2, the National Board of Revenue (NBR) was formally requested to take the necessary steps to implement the measure. The decision follows recommendations from the Bangladesh Tariff Commission and long-standing demands from the Bangladesh Textile Mills Association (BTMA).

The commerce ministry noted that imports of low-count yarn increased sharply in recent years due to the availability of bonded benefits under HS headings 52.05, 52.06 and 52.07. In fiscal year 2022–23, imports under these headings stood at about 36,000 tonnes, valued at Tk 14.8 billion.

The trend intensified in 2023–24, when imports rose to nearly 41,000 tonnes and the value exceeded Tk 22 billion. Early data from fiscal year 2024–25 also indicate a continued rise in both volume and value.

According to the ministry, low-count yarn imported at zero or reduced duty under bonded facilities was being sold in the domestic market at lower prices, eroding the competitiveness of local spinning mills.

Although domestic mills have sufficient installed capacity, they are currently operating at only around 60 percent utilisation. This underuse of capacity has weakened the sector’s financial health and discouraged fresh investment, officials said.

Industry sources said sales of locally produced yarn have dropped significantly, with around 50 spinning mills already shutting down. Many others are operating at a loss, raising concerns about further closures if the situation persists.

The ministry also warned that growing reliance on imported yarn is gradually making the garment sector import-dependent. This, in turn, is weakening backward linkages in the textile value chain and increasing long-term structural risks for the industry.

Looking ahead to the post-LDC period, the ministry noted that Bangladesh is set to graduate from LDC status in 2026, after which it will lose most duty-free access to key markets such as the European Union, the United States and Japan.

To secure trade preferences under free trade agreements, comprehensive economic partnership agreements (CEPAs) or GSP Plus schemes, exporters will need to ensure 40 to 80 percent local value addition and comply with double-stage transformation rules.

Officials cautioned that heavy dependence on imported yarn would make it difficult to meet these conditions. They added that continuation of bonded benefits for low-count yarn imports would further discourage domestic investment and weaken export competitiveness by increasing production costs and lead times.

By withdrawing the bonded facility, the government expects to restore balance in the spinning sector, boost local production, safeguard employment and strengthen Bangladesh’s overall competitiveness in global apparel trade.