Customers have taken collateral-free digital loans more than 12.7 million times from the City Bank through the bKash app, with total disbursements exceeding Tk 50 billion within three years of the service’s launch, an official release said.

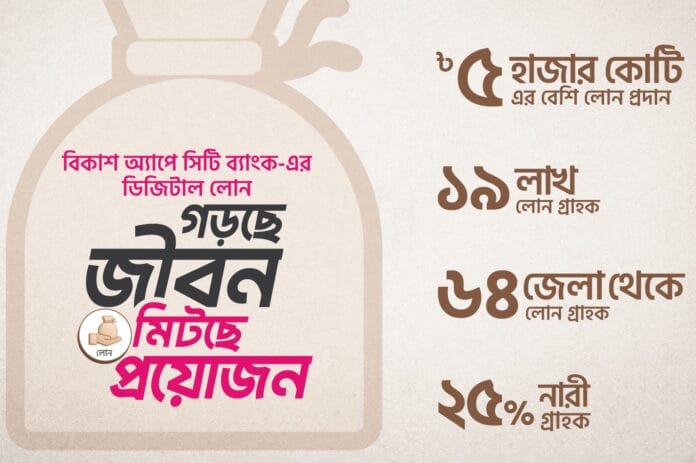

Customers have taken collateral-free digital loans more than 12.7 million times from the City Bank through the bKash app, with total disbursements exceeding Tk 50 billion within three years of the service’s launch.

So far, over 1.9 million customers from all 64 districts of the country have availed the facility, with women accounting for 25 per cent of borrowers. Most users have taken loans multiple times, reflecting growing reliance on the digital credit service.

The instant loan facility available through the bKash app is expanding access to finance for unbanked and underserved customers, contributing to sustainable financial inclusion. Without paperwork or physical visits, customers can instantly access collateral-free loans ranging from Tk 500 to Tk 50,000 at any time with just a few taps on the app.

Using transaction data and advanced technology, the City Bank automatically determines loan eligibility and limits for applicants. Borrowers report using the loans for medical treatment, education, business capital, starting new ventures, travel and other emergency needs.

Customers can view interest rates, processing fees and other charges directly in the app before taking a loan. Instalments are automatically deducted on scheduled dates if sufficient balance is available, while early repayment allows interest to be charged only for the number of days the loan is used. Due dates are communicated through in-app notifications and SMS alerts.

To further support emergency and everyday purchases, bKash and the City Bank have also introduced a “Pay-Later” service.