Bangladesh is entering the peak Boro paddy irrigation season amid growing concerns that shortages of gas and liquid fuel could strain reliable electricity generation, despite official assurances of preparedness.

According to the government’s Generation and Fuel Requirements Scenario for the January-May 2026 irrigation period, the country’s total installed power generation capacity currently stands at 28,504 megawatts.

However, effective output during peak irrigation hours will depend largely on fuel availability –particularly natural gas and imported liquid fuels — rather than installed capacity alone.

Rising irrigation demand meets fuel constraints

Power sector data show that electricity demand for irrigation rises sharply between January and May, in line with the Boro cultivation cycle.

Month-wise demand patterns indicate that irrigation loads begin increasing in February and peak during March and April, placing additional pressure on an already constrained fuel supply chain.

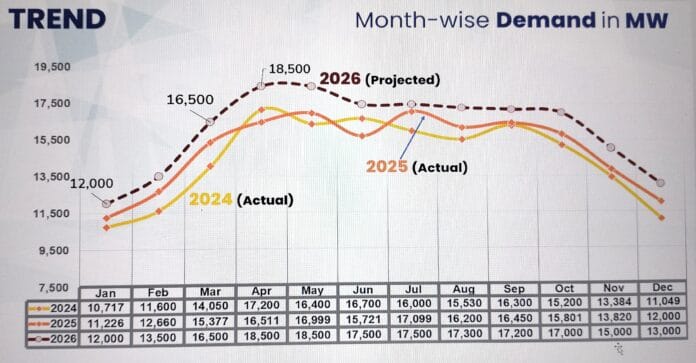

Bangladesh Power Development Board (BPDB) projections show overall electricity demand rising from around 12,000 MW at present to about 18,500 MW during April and May 2026, which coincide with the peak irrigation period and the election month.

Of this, Boro irrigation alone is expected to account for roughly 3,000 MW of dedicated demand.

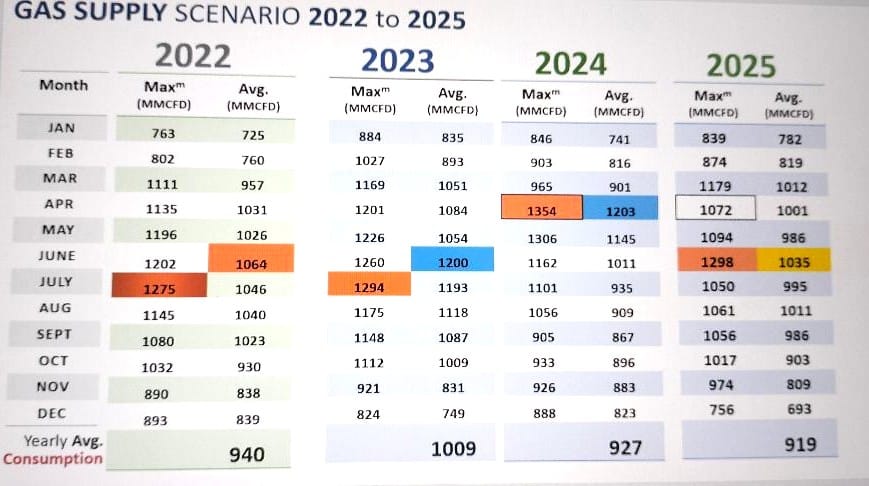

While electricity demand continues to grow, gas supply has remained structurally tight since 2022, with average annual consumption consistently exceeding available supply.

The 2026 monthly gas demand-supply outlook suggests that shortages are likely to persist throughout the irrigation season, particularly during evening peak hours when household and commercial consumption overlaps with agricultural use.

On average, about 1,200 million cubic feet per day (mmcfd) of natural gas is required to generate 6,840MW of electricity during the peak Boro paddy irrigation season between March and May this year. However, the Bangladesh Power Development Board (BPDB) received an average of only 919mmcfd of gas in 2025. Even a supply of 1,000mmcfd would be sufficient to generate only around 5,700MW from gas-fired power plants, leaving more than half of the installed gas-based capacity unused against a total capacity of 12,204MW.

Meanwhile, two coal-fired power plants—the 1,200MW Matarbari plant and the 1,320MW Patuakhali plant—have yet to complete tender evaluation procedures for coal procurement ahead of the peak Boro season. This has resulted in a reduction of around 2,500MW in coal-fired generation capacity.

Liquid fuels, mainly furnace oil and diesel, are expected to cover part of the shortfall, but these options are significantly more expensive and heavily dependent on timely imports and transport logistics. Moreover, fuel purchased by BPDB from the state-owned Bangladesh Petroleum Corporation is costlier than supplies used by privately sponsored plants, further exacerbating the fuel crisis.

The planning document confirms that monthly fuel demand requests have already been submitted to Petrobangla and the Bangladesh Petroleum Corporation (BPC), underscoring official recognition that fuel availability, rather than generation capacity, remains the principal risk this season.

Load management over new generation

Instead of relying on new power plants, authorities are prioritising demand-side management measures. A key strategy is to shift irrigation pumping away from the evening peak hours.

Officials estimate that if most irrigation load can be moved to midnight-to-dawn periods, evening peak demand could be reduced by around 2,000 MW, easing pressure on fuel-constrained power plants during critical hours.

At a meeting held on 4 January, 2026, BPDB officials proposed closer monitoring and restrictions on irrigation pump operations during peak hours, alongside efforts to encourage farmers to shift irrigation to off-peak periods.

The BPDB also proposed shutting compressed natural gas (CNG) filling stations during evening peak hours to divert gas supplies to power generation.

Agricultural water efficiency as an energy tool

In a notable policy linkage between the energy and agriculture sectors, authorities are urging farmers to adopt the “Alternate Wetting and Drying” (AWD) cultivation method promoted by the agriculture department.

The technique reduces water consumption and, by extension, electricity demand for pumping, an implicit acknowledgment that fuel scarcity is influencing farm-level practices.

Infrastructure readiness, but fuel risk remains

On the technical front, maintenance of grid substations, transmission lines and distribution networks has been underway since December and is scheduled for completion by the end of January 2026.

Officials say spare parts have been stocked, while capacitor banks are being installed in low-voltage areas to improve power factor and reduce system losses.

Sector analysts, however, caution that such measures can only mitigate — not eliminate — risk.

Fuel transport logistics, particularly the availability of railway wagons for furnace oil and diesel, remain a potential bottleneck, while gas supply ultimately depends on upstream availability and competing demand from industry and households.

A fragile balance

The planning documents portray a power system attempting to balance rising irrigation demand, limited domestic gas supply, and costly liquid fuel imports.

While load management and efficiency measures may help avert widespread outages, they also underscore a deeper vulnerability: installed generation capacity does not guarantee reliable power without assured fuel supply.

As the Boro season progresses, the effectiveness of off-peak irrigation, fuel deliveries and gas allocation decisions will determine whether farmers receive uninterrupted electricity — or whether fuel shortfalls once again translate into load shedding during a critical agricultural period.

Fuel supply to feed power plants

At an early-January meeting chaired by Power Division Secretary Farzana Momtaz, authorities were instructed to complete the tender process for LNG procurement as quickly as possible and to finalise all necessary arrangements by February 2026.

The meeting also decided that the evaluation process for coal procurement for the Rampal and Payra thermal power plants must be completed on an urgent basis, with responsibility assigned to BPDB and the Bangladesh-India Friendship Power Company Limited (BIFPCL).

In view of the upcoming national election, the holy month of Ramadan, and the irrigation and summer seasons, officials agreed to prepare a list of power plants capable of operating at optimum efficiency.

The list will be sent to the Fuel and Mineral Resources Division to ensure uninterrupted gas supply to those plants.

Power plants running on heavy fuel oil (HFO) have been directed to maintain minimum fuel stocks sufficient for at least 15 days of generation.

BPDB has also been instructed to hold internal discussions on the overall management and procurement of HFO and LNG and to take the necessary follow-up measures.

Earlier this month, Power and Energy Adviser Muhammad Fouzul Kabir Khan met Finance Adviser Dr Salehuddin Ahmed and sought additional funding support to procure fuel for Boro irrigation during the upcoming summer months.

He also requested the release of subsidies for the Rampal and Payra power plants, which have remained suspended due to the non-signing of power purchase agreements.

Expert view

Energy expert Prof Ijaz Hossain said the next elected government would have to bear the long-term costs of what he described as overcapacity in the power sector and inadequate investment in domestic gas exploration over the past 15 years.

“The next government’s first and most formidable task should be to shut down oil-based power plants within its five-year term,” he said.

“At the same time, renewable energy should be increased by at least one percentage point each year, reaching 5% in five years. Bangladesh already has a target of 20% solar power by 2030. If that target is met, it will be sufficient.”

He added that avoiding luxury consumption would be essential and that load shedding should be enforced if necessary.