The Bangladesh Energy Regulatory Commission (BERC) has raised natural gas tariffs by 33 percent for new industrial units and captive power generation, despite opposition from consumer groups.

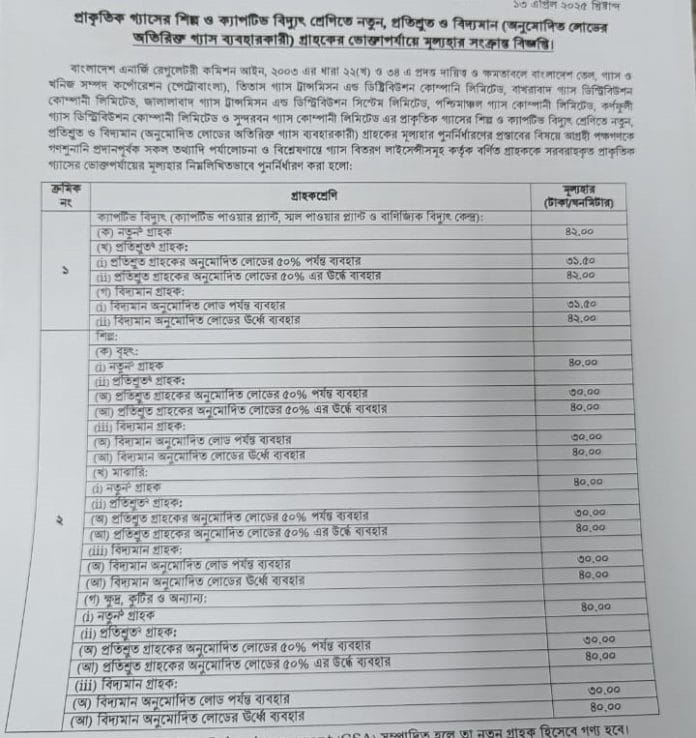

Under the new tariff, effective from April, the price of gas for industrial boiler use has been increased from Tk 30 to Tk 40 per cubic meter.

Similarly, for captive power use, the price has gone up from Tk 31.75 to Tk 42.

This means both new industrial establishments and those exceeding their approved gas load will now have to pay the higher rate.

Energy experts have expressed concern that such a sudden price hike, without in-depth analysis or stakeholder consensus, will hinder industrial investment, create unequal competition, and deepen disparity in the industrial sector.

They warn of negative ripple effects across the broader economy.

The new pricing was announced at a press conference held at the BERC office in Karwan Bazar.

BERC Chairman Jalal Ahmed, accompanied by commission members including Mizanur Rahman, Syeda Sultana Razia, Md. Abdur Razzak, and Shahid Sarwar, defended the decision despite widespread criticism.

When questioned by journalists about the potential for discrimination between old and new industrial units, the chairman denied the possibility of inequality, suggesting that industries needing gas can simply apply for new connections.

He also suggested alternative fuels like LPG, solar energy, and grid electricity as viable options for investors.

Asked why the price was raised despite public opposition during the regulatory hearing, BERC officials cited high costs associated with importing LNG and the need to reduce government subsidies.

However, they admitted they had no clear projection of the additional revenue the government would earn from this hike, nor was there any assessment of the impact on Petrobangla and gas distribution companies’ income.

If prices were increased by 75 percent, around Tk 3,240 crore could be earned, but the current hike is lower than that, the chairman said.

Interestingly, BERC admitted that no formal financial audit or review was conducted before determining the new price.

The price hike was not made under direct instruction from the Ministry of Power, Energy and Mineral Resources either, according to the chairman.

The dual pricing structure—lower rates for existing industries and higher rates for new entrants—has sparked debate over its legality and potential to deter fresh investment.

The chairman, however, maintained that the decision was within BERC’s legal framework and that its impact on investment will be monitored going forward.

During the press conference, BERC also acknowledged calls from the public hearing participants to reduce ‘system loss’ rather than increase prices.

Officials admitted that this would be difficult but committed to enhancing financial transparency by evaluating the financial statements of gas companies with the help of professional auditors.

Petrobangla earlier warned that failing to raise prices could result in an annual deficit of Tk 16,000 crore. The proposal faced strong opposition during the February 26 public hearing, especially from industry leaders who rejected the idea of a two-tier pricing system, calling it unfair and anti-competitive.

Energy expert Dr. Shamsul Alam remarked that BERC ignored data-backed arguments made during the hearing that showed how prices could actually be lowered.

He criticized the commission for following in the footsteps of the previous government by promoting wasteful spending instead of protecting consumer interests.

This is not the first time gas prices have risen sharply. In January 2023, the government increased industrial gas prices by 150 to 178 percent, setting the rate at Tk 30 per unit. Later that year, the captive rate was adjusted to Tk 31.50.

Petrobangla procures gas from various sources, including state-owned entities and multinational companies. Local state-run firms like Sylhet Gas Fields and Bangladesh Gas Fields supply gas at around Tk 28 per thousand cubic feet, while BAPEX charges Tk 112. Multinationals such as Chevron and Tullow receive $2.76 and $2.31 per thousand cubic feet, respectively.

Meanwhile, LNG imports from Qatar and Oman during the first seven months of FY 2024-25 cost $10.66 and $10.09 per unit, respectively.

Due to prolonged stagnation in domestic gas exploration, experts warn that reliance on imports will grow, making the energy sector increasingly vulnerable unless local exploration is ramped up significantly.