Petrobangla is now in a position to launch an offshore bidding round under the newly elected government led by BNP after the Ministry of Law vetted the draft Offshore Model Production Sharing Contract (MPSC) 2026.

This introduces major reforms in gas pricing, pipeline cost recovery and work obligations aimed at attracting international oil companies (IOCs).

“We received approval from the Legislative and Parliamentary Affairs Division under the Ministry of Law on February 8, 2026,” Energy and Mineral Resources Division (EMRD) Secretary Mohammad Saiful Islam told Just Energy News.

However, Power, Energy and Mineral Resources Adviser Muhammad Fouzul Kabir Khan said the finalisation of the bid documents would be “a gift for the next elected government.”

Officials said the government reviewed both the upper and lower pricing ceilings to make the terms more attractive for foreign oil companies and introduced a negotiable pipeline tariff mechanism.

The draft also withdraws the requirement to allocate 5% of profits to the Workers’ Welfare Fund (WWF).

According to official documents, the new model links gas prices to Brent crude oil, moving away from the earlier high-sulphur fuel oil (HSFO)-based formula.

Under the proposal, gas from deep-sea blocks will be priced at 11% of Brent’s three-month average, with a floor of $70 and a ceiling of $100 per barrel.

Shallow-sea blocks will receive 10.5% of Brent, while onshore exploration will be priced at 8% in plain land areas and 8.5% in hilly regions.

The draft marks a significant shift from the 2023 model, which offered a flat 10% of Brent (capped at $100) but failed to generate investor interest.

Only seven bid documents were purchased and none submitted amid political uncertainty. Under earlier arrangements, ceiling prices were fixed at $5.60 per MMBtu for shallow-sea gas and $7.26 for deep-sea blocks.

The changes follow recommendations made in 2022 by global consultancy Wood Mackenzie and are intended to align Bangladesh’s fiscal terms with international benchmarks.

The draft retains full cost recovery for pipelines and facilities, with tariffs to be determined under petroleum sales agreements.

To accelerate exploration, it introduces stricter minimum work obligations, requiring contractors to conduct extensive 2D and 3D seismic surveys shortly after contracts take effect.

Another notable update is the replacement of the LIBOR benchmark with the Secured Overnight Financing Rate (SOFR) for payment calculations.

Energy experts have cautiously welcomed the reforms, saying the framework’s success will depend on investor confidence and political stability.

Speaking at a Just Energy News dialogue, energy expert and former professor of Bangladesh University of Engineering and Technology (BUET) Dr Ijaz Hossain said Bangladesh must assess its gas potential to ensure effective planning over the next two to three years.

“Today, 97 to 98% of our total energy supply is fossil fuel-based, while around 60% of power and energy is import-dependent,” he said, adding that import reliance has intensified over the past year, putting severe pressure on foreign exchange reserves.

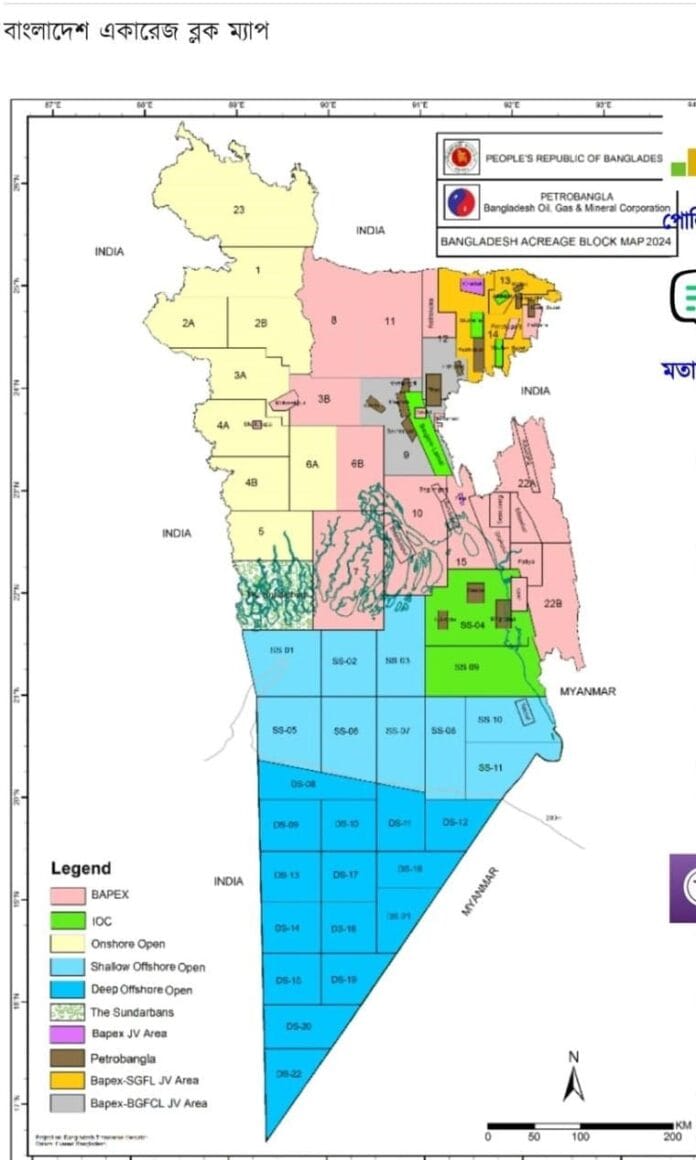

He urged the newly elected government to properly develop onshore gas resources in Bhola and immediately launch bidding rounds for deep offshore blocks.

He also recommended doubling exploratory drilling activities by raising funds through the issuance of gas bonds.

In addition, he suggested that Petrobangla establish a separate entity to undertake exploration in partnership with foreign companies that have reservoir and drilling expertise.

He warned that inefficiencies and irregularities in the gas sector have become more severe since the shift to imported LNG. According to his analysis, nearly 10% of gas supplied is lost due to theft and mismanagement.

“When 30 to 33% of total gas supply comes from imported LNG, such losses translate into billions of dollars in direct foreign exchange wastage every year,” he said, noting that curbing leakage could significantly ease dollar shortages.

Prof. M. Tamim, energy analyst and vice-chancellor of Independent University, Bangladesh (IUB), warned of an impending supply crisis. He said the newly elected government should take tough decision to overcome the crisis.

Prof Tamim said domestic gas remains the cheapest source of electricity and warned that power generation without indigenous fuel cannot be delivered below Tk10 per unit.

He said excessive reliance on imports has undermined opportunities to develop local resources.

“Hard, politically sensitive decisions are unavoidable, but they must be taken carefully and transparently,” he said.