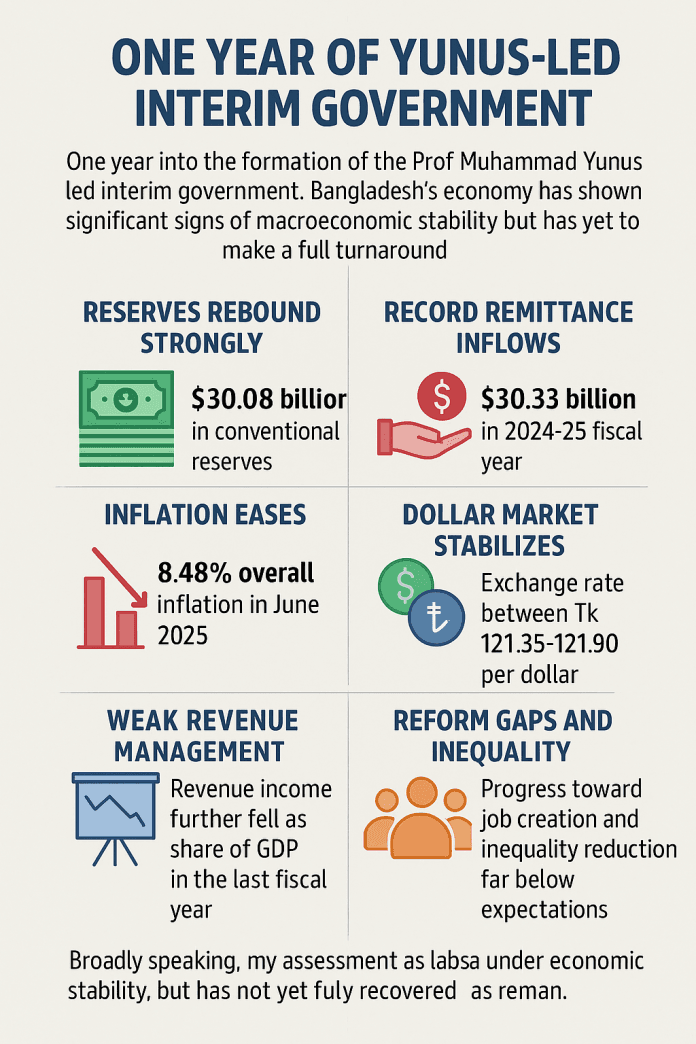

One year into the Prof Muhammad Yunus-led interim government, Bangladesh’s economy has made notable strides toward macroeconomic stability but has yet to achieve a full recovery.

When Dr Yunus assumed leadership on August 8, 2024, after a mass uprising toppled the Sheikh Hasina regime, the country was grappling with an acute foreign exchange shortage, a free-falling taka, mounting inflation, entrenched corruption, and a fragile banking sector plagued by non-performing loans. Restoring trust and stabilising the economy became immediate priorities.

On August 28, 2024, the government formed a committee to draft a white paper exposing structural weaknesses in the financial system. This was followed on September 11 by a specialized task force to spearhead reforms – initiatives that laid the foundation for a year of transformation.

Over the past 12 months, public confidence in the banking system has grown, reserves have risen, inflation has eased, remittance inflows have hit record highs, and exports have increased. A significant portion of foreign debt has been repaid, easing fuel imports. The withheld tranche of the IMF loan was released, further boosting reserves.

The central bank is now buying US dollars to curb excessive taka appreciation and protect export and remittance competitiveness.

Persistent Weaknesses in Revenue Management

Despite these gains, revenue generation, job creation, private-sector credit growth, and public spending remain weak. As a share of GDP, revenue fell in the last fiscal year, and tax administration remains disorganised.

Revenue expenditure – particularly salaries, subsidies, and interest payments – has grown so sharply that no surplus remains for development spending. Development projects are now fully dependent on borrowing, creating an imbalance that could become a major concern.

“Broadly speaking, there has been a sense of relief in terms of economic stability, but the economy has not yet fully recovered. Achieving that will require sustainable reforms,” said Dr Debapriya Bhattacharya, distinguished fellow at the Centre for Policy Dialogue (CPD).

Reserves Rebound Strongly

Foreign currency reserves, which had plunged to $20.47 billion in August 2024 (IMF’s BPM6 method) from a $48 billion peak in 2021, climbed to $25.06 billion within a year – and stand at $30.08 billion by conventional calculation. The central bank, instead of making large reserve payments, is now actively purchasing dollars to ease market liquidity.

Remittances surged to a record $30.33 billion in FY2024–25, up 26.8% from the previous year. Central bank officials attribute the turnaround to political stability, new incentives, and stronger policy support for overseas workers.

Overall inflation fell from 10.49% in August 2024 to 8.48% in June 2025, with food inflation at a near three-year low of 7.39%. The drop is credited to tighter monetary policy, interest rate hikes, eased import restrictions, and lower tariffs on essentials.

Fears of the dollar crossing Tk 160–170 have dissipated. The exchange rate now holds between Tk 121.35 and 121.90, aided by central bank interventions and confidence-building measures.

In June 2024, official non-performing loans stood at Tk 2.11 trillion. Greater scrutiny under the interim government revealed the true figure – Tk 5.3 trillion, or 27% of total loans – exposing years of fake collateral, political interference, and lax regulation.

Bangladesh Bank dissolved and reconstituted the boards of 14 banks long associated with mismanagement. Some are now showing recovery, supported by deregulated interest rates, stabilised imports, and improved reserve management.

“We’re not chasing politics. We’re focused on economic stability. If these reforms are sustained, Bangladesh could soon establish a strong, self-reliant economic foundation,” said Dr Salehuddin Ahmed, economic adviser to the interim government.

Reform Gaps and Inequality Concerns

Dr Debapriya cautioned that real recovery will come only when inflation falls enough for the central bank to cut policy rates, stimulating private investment, imports of capital goods, and job creation.

He noted that employment growth and inequality reduction remain far below expectations. “The popular uprising was driven by anti-inequality sentiment. If gains don’t reach the marginalised – if farmers don’t get fair prices and workers’ wages lag behind inflation – it would be deeply unfortunate.”

He also warned of rising violence against women and growing vulnerabilities among religious and ethnic minorities. “The stability we now praise carries a shadow. That darker side demands urgent attention.”