Bangladesh has formed a committee to conduct a comprehensive review of the draft Offshore Model PSC 2025, including newly incorporated provisions, and to provide recommendations on the proposed Model Production Sharing Contract (PSC).

The committee is headed by Mohammed Mohsin, chairman of the board of directors of Bangladesh Gas Fields Company Ltd (BGFCL), as convener.

Other members include Professor Dr M Tamim, vice-chancellor of Independent University, Bangladesh; Abul Monir Md Fayez Ullah, chairman of the board of directors of Sylhet Gas Fields Ltd (SGFL); Dr S M Michael Kabir, associate professor of geology at the University of Dhaka; and Dr Sinthia Farid, barrister-at-law and advocate of the Supreme Court of Bangladesh.

Officials from Petrobangla on the committee are Director (PSC) Engr Md Shoyeb, General Manager (Contracts) Hasan Mahmudul Islam, General Manager (Reservoir and Data Management) Meherul Hasan, and General Manager (Exploration) Farhana Shaon, who will serve as member-secretary.

The Energy and Mineral Resources Division (EMRD) issued an official order in this regard today, signed by Deputy Secretary Ahmed Ziaur Rahman, following a directive from Power and Energy Adviser Muhammad Fouzul Kabir Khan last Sunday.

According to the terms of reference, the committee will conduct an overall review of the draft Offshore Model PSC 2025 and submit its report by January 15, 2026. Petrobangla will provide secretarial and logistical support to the committee, which may also co-opt additional members if necessary.

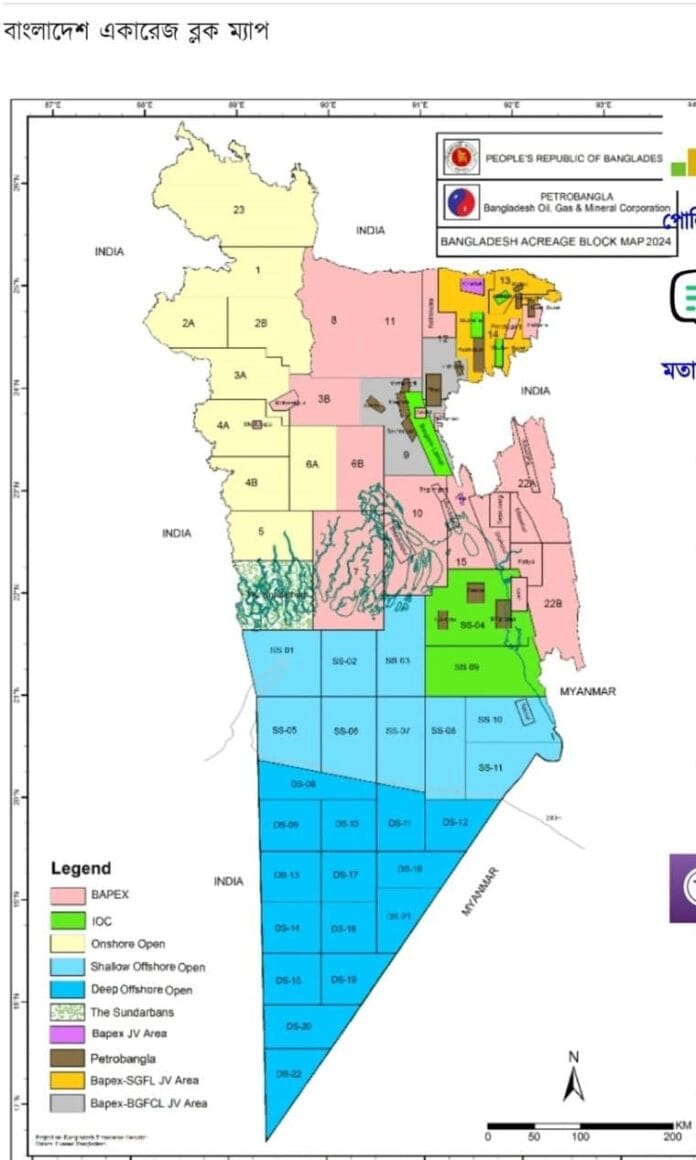

Petrobangla has already finalised the draft Offshore Model Production Sharing Contract (MPSC) 2025, introducing major reforms in gas pricing, pipeline cost recovery and work obligations to attract international oil companies (IOCs).

The draft was discussed to the EMRD on Sunday last for approval in presence of power and energy adviser. According to official documents, the new model links gas prices to Brent crude oil, moving away from the outdated high-sulphur fuel oil (HSFO)-based pricing structure.

Under the proposal, gas from deep-sea blocks will be priced at 11 per cent of Brent’s three-month average, with a floor of $70 and a ceiling of $100 per barrel. Shallow-sea blocks will receive 10.5 per cent of Brent, while onshore exploration will fetch 8 per cent on plain land and 8.5 per cent in hilly areas.

The 2025 framework marks a significant shift from the 2023 model, which offered a flat 10 per cent of Brent (capped at $100) but failed to attract investor interest, with only seven bid documents purchased and none submitted amid political uncertainty. Previously, ceiling prices were fixed at $5.6 per MMBtu for shallow-sea gas and $7.26 per MMBtu for deep-sea blocks.

The changes follow recommendations by global consultancy Wood Mackenzie in 2022 and are aimed at aligning Bangladesh’s contractual terms with international benchmarks.

The draft also retains full cost recovery for pipelines and facilities, with tariffs to be set under petroleum sales agreements. To accelerate exploration, it introduces stricter minimum work obligations, requiring contractors to undertake extensive 2D and 3D seismic surveys soon after contracts take effect.

Another notable update is the replacement of the LIBOR benchmark with the SOFR (Secured Overnight Financing Rate) for payment terms.

The government also plans to make fiscal terms more attractive and introduce subsea pipeline tariff also as a cost recovery procedures.

Energy experts have cautiously welcomed the reforms, noting that the framework’s success will depend on investor confidence and political stability.

“We are taking all preparations for inviting bids for both onshore and offshore exploration, but the final decision will be made by the next elected government,” EMRD Secretary Mohammad Saiful Islam earlier told Just Energy News.

Professor M Tamim, an energy analyst and vice-chancellor of Independent University, Bangladesh, warned of an impending supply crunch.

“The gas sector in Bangladesh is heading towards disaster within four to five years. Supplies will fall rapidly, and without alternatives, even households will struggle to use burners,” he said.