Petrobangla and its 13 subsidiaries disbursed Tk1,247.42 crore in Ex-Gratia, Workers’ Profit Participation Fund (WPPF), and incentive bonuses over the past five years, even as the government injected Tk30,712.68 crore in subsidies to keep the state-run energy sector afloat.

A recent Energy and Mineral Resources Division (EMRD) review flagged serious irregularities, revealing that several loss-making companies distributed hefty incentive and Ex-Gratia payments in violation of financial discipline.

According to the findings, Titas Gas, Bakhrabad Gas Transmission, and Madhapara Granite Mining Company disbursed Ex-Gratia benefits despite posting negative net profits. The revelations come as the energy sector struggles with declining gas reserves, soaring LNG import bills, and low exploration investment.

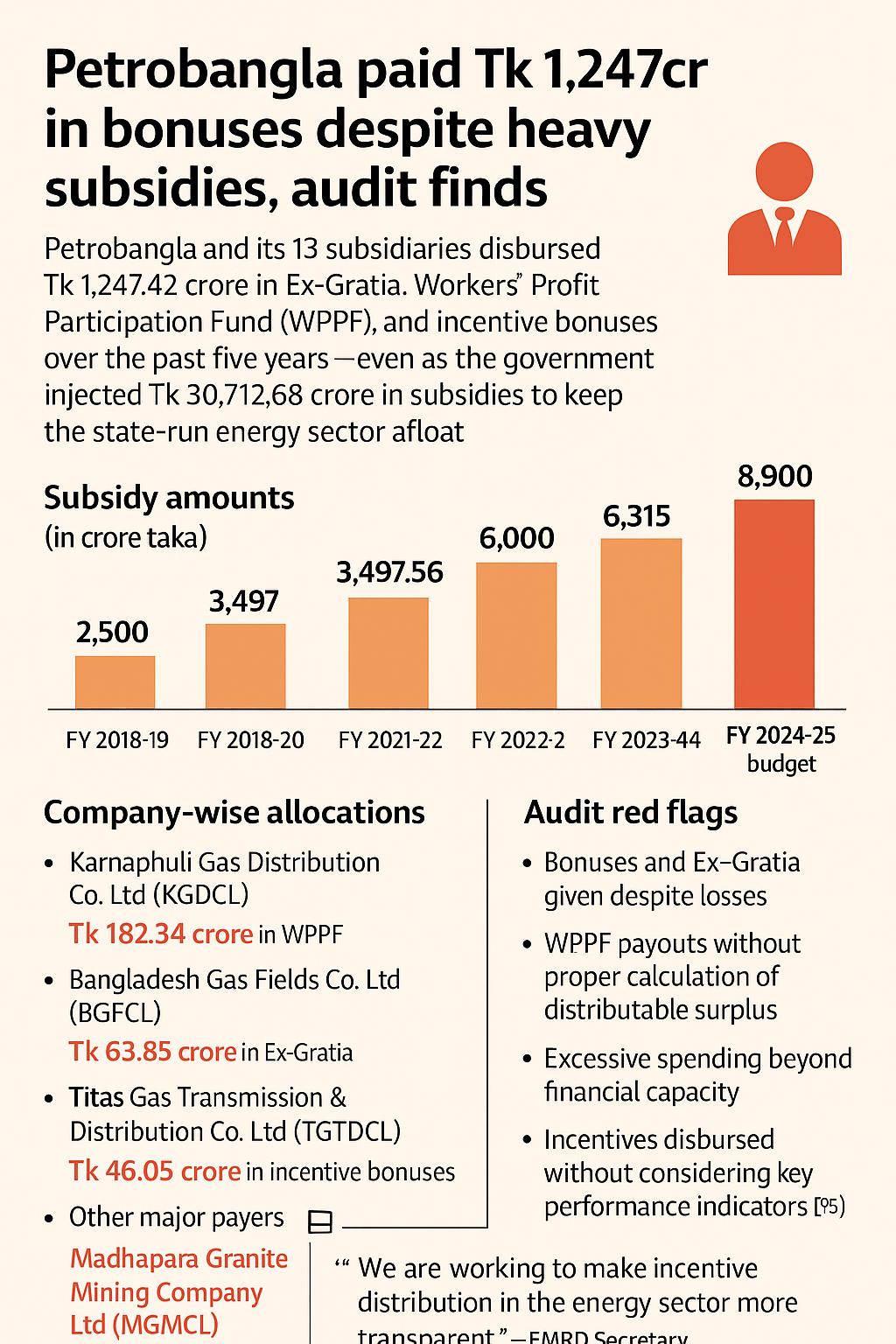

“We provided Tk36,712.68 crore in subsidies between FY2018-19 and FY2024-25, of which Tk30,712.68 crore was spent in the past five years alone. Yet Petrobangla and its subsidiaries paid Tk1,247.42 crore in bonuses and incentives,” an EMRD official said.

Over the past seven years, the government has steadily increased subsidies to Petrobangla and its subsidiaries. In fiscal year 2018-19, Tk2,500 crore was provided, which rose to Tk3,500 crore in 2019-20. The allocation remained almost the same in 2020-21 at Tk3,497.56 crore.

The support grew sharply from 2021-22, when Tk6,000 crore was injected, followed by Tk6,315 crore in 2022-23. In 2023-24, the subsidy stood at Tk6,000 crore.

For the fiscal year 2024-25, the government earmarked the highest amount so far, Tk8,900 crore, including Tk2,400 crore in special allocations.

Company-wise allocations include: Karnaphuli Gas Distribution Co. Ltd (KGDCL) Tk182.34 crore in WPPF (highest), Bangladesh Gas Fields Co. Ltd (BGFCL) Tk63.85 crore in Ex-Gratia (highest), and Titas Gas Transmission & Distribution Co. Ltd (TGTDCL) Tk46.05 crore in incentive bonuses (highest).

Other major payers are Sylhet Gas Fields Ltd (SGFL), Gas Transmission Company Ltd (GTCL), Sundarban Gas Company Ltd (SGCL), and Rupantarita Prakritik Gas Company Ltd (RPGCL). Madhapara Granite Mining Company Ltd (MGMCL) received the lowest allocations.

Audit red flags include bonuses and Ex-Gratia given despite losses, WPPF payouts without proper calculation of distributable surplus, excessive spending beyond financial capacity, and incentives disbursed without considering key performance indicators (KPIs).

The EMRD review proposed a separate guideline barring loss-making firms from paying bonuses, incentives limited to special contributions, not routine entitlements, policy-based administrative controls to curb arbitrary disbursements, and approval of benefits only when firms show profitability, liquidity, and compliance with statutory rules.

Experts say such payments are common in state-owned enterprises but raise concerns given the sector’s reliance on subsidies and imported LNG. Critics warn the payouts weaken reinvestment capacity in exploration and infrastructure, though supporters argue they help maintain workforce morale.

The government is now considering a new policy framework. “We are working to make incentive distribution in the energy sector more transparent,” EMRD Secretary Mohammed Saiful Islam told Just Energy News.