A dispute has emerged between Bangladesh’s Power Division and the Energy and Mineral Resources Division (EMRD) over a proposed coal tariff hike for the country’s only operational coal mine at Barapukuria, which supplies coal to a nearby power plant.

The EMRD-backed proposal seeks to raise the coal price to US$202 per metric tonne last April, up from $176 set in 2022 following a post-COVID surge in global coal prices.

However, the Bangladesh Power Development Board (BPDB), under the Power Division, has rejected the increase, citing financial strain and recommending a reduced tariff of $106.53 per tonne, aligned with the Indonesian Coal Index (ICI-1) as of January 2025.

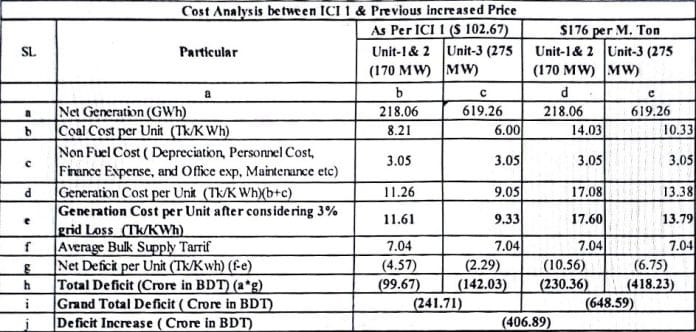

According to BPDB, the higher coal price significantly increased its losses – rising from Tk 406.89 crore to Tk 648.59 crore between January and June 2025–despite Barapukuria Coal Mining Company Ltd (BCMCL) posting a Tk 431.65 crore net profit during the same period.

BPDB Secretary Md Rashedul Huque Prodhan, in a letter to the Power Division in late July, highlighted the rising cost of power generation at Barapukuria. Units 1 and 2 are generating electricity at Tk 11.61 per unit, and Unit 3 at Tk 9.33, against a bulk power tariff of Tk 7.04.

Based on ICI-1 pricing at $106.53, BPDB incurs losses of Tk 4.57 per unit (Units 1 and 2) and Tk 2.29 (Unit 3). If the $176 rate continues, losses could rise to Tk 10.56 and Tk 6.75, respectively.

The letter warned that BPDB, which directly oversees the plant without government subsidies, may have to raise tariffs if BCMCL enforces the price hike.

BCMCL Managing Director Md Shaiful Islam Sarkar told Just Energy News that the $176 rate was maintained through 2024. However, from January 2025, BPDB began paying only $106-$107 per tonne, citing ICI-based pricing.

He added that a joint BPDB-Petrobangla committee proposed a revised $202 rate in April 2025 based on a 10% profit margin, but the BPDB representative refused to sign the resolution, leaving the matter unresolved.

Meanwhile, coal procurement from BCMCL has dropped to 1,500-1,600 tonnes per day – far below the 5,000-5,500-tonne demand – due to reduced power plant operations and technical issues across all three Barapukuria units.

The government plans to produce 3.2 million tonnes of coal from the mine’s northern section by December 2027. While half that target has already been met from the central section by a Chinese contractor, delays in northern production threaten further disruption.

With BCMCL holding a 3.15 lakh-tonne stockpile and plants sitting on 75,000 tonnes, officials warn that continued procurement shortfalls could halt operations and trigger Liquidated Damages (LD) clauses in the production agreement.

An inter-ministerial meeting is expected soon to resolve the pricing impasse.